Unit trust local Malaysia Also known as a mutual fund or actively managed fund it is a regulated structure that pools money from hundreds of investors both big and small into a collective investment scheme. What is a Private Retirement Scheme PRS.

New Funds On Board.

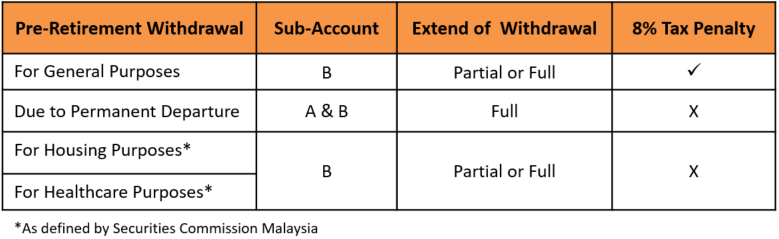

. You can only withdraw your money from Sub-Account A if you. Only upon reaching the retirement age of 55 years or in the case of death or emigration can withdrawals be made from the PRS account. The PRS Tax Relief was specially introduced to encourage you to save more for your retirement.

For conventional choose between MaxiHome and My First Home Financing Scheme. Updated Aug 10 2021. National Pension Scheme SBI is a voluntary scheme and allows any Indian citizen between the ages of 18 and 60 years to open a pension account.

PRS is a voluntary investment scheme to help you save for retirement. 5 Companies With the Best Retirement Plans. The minimum retirement age increased from 55 to 60 for civil servants and the private sector employees in Malaysia.

LIC pension plans are a good way to earn pensions for people employed in the private sector. The National Pension Scheme SBI account holders will each receive a Permanent Retirement Account Number PRAN that will remain fixed throughout the premium payment and pension payment periods. PRIVATE RETIREMENT SCHEME Public Ruling No.

The scheme has been introduced with a modified pension rate under the plan and an extended period of sale from the financial year. The fund will have a mandate stating what it can or cannot invest in which directly reflects the risk rating or risk appetite of the. 92021 INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Private Retirement Scheme PRS Gold Investment Share Trading Insurance. B take custody and control of all securities derivatives property. Find the best unit trust price in Malaysia only at FSMOne.

For Islamic choose between Commodity Murabahah Home Financing. This tax incentive is available until assessment year 2025. We are an online unit trust fund marketplace offering you a diverse variety of funds at low rates.

Access PEREs dynamically searchable private real estate database now and find thousands of investors fund managers and fund details. PRS is similar to the Employees Provident Fund EPF in that it is a retirement scheme. Best Mobile Banking App and Outstanding Wealth Management Service for the Affluent at the Global Private Banking Innovation Awards 2020.

The act doesnt prevent employees from choosing to retire early if the contract of service or. Is a Deferred Retirement Option Plan Right for. 29 December 2021 Page 4 of 20 a at all times exercise its powers for a proper purpose and in good faith in the best interests of investors as a whole.

LinkedIn Top Companies in Malaysia 2021. Sub-Account A and Sub-Account B. However it is limited to high-rise buildings.

Like with EPF PRS contributions are also divided 7030 into two sub-accounts. It has introduced Pradhan Mantri Vaya Vandana Yojana intending to secure the life of the individual after retirement. Best Trade Finance Solution for Vale at The Asset Triple A Treasury Trade Sustainable Supply Chain and Risk Management Awards 2021.

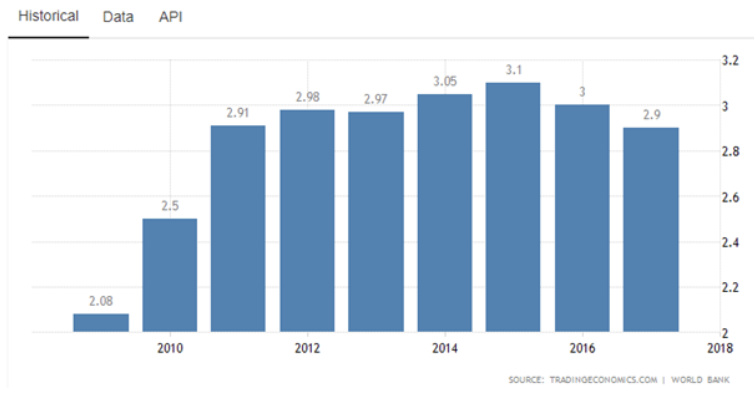

Non-Core funds have performed the best with average annualised returns of 824 followed by Core Growth 793 Core Moderate 63 and Core Conservative 407. Enjoy the flexibility to choose from our range of conventional and Islamic financing options. Minimum Retirement Age Act 2012.

Best and Worst Performers. Telekom Malaysias UniFi service has the widest coverage at the moment. The good news is an individual who makes contribution to his or her PRS funds is allowed to claim personal tax relief of up to RM3000 by the Inland Revenue Board of Malaysia.

Find and compare the best home and office Internet plans in Malaysia from Internet providers such as TM Net TIME Maxis Astro IPTV and P1.

A Guide To The Private Retirement Scheme Prs

25 Types Of Investment In Malaysia Take Quiz To Find Yours

Cover Story Is Prs Outperforming Epf The Edge Markets

Which Prs Funds To Invest In 2020 2021 Mypf My

Prs Provider Aia Pension And Asset Management Sdn Bhd Private Pension Administrator Malaysia Ppa

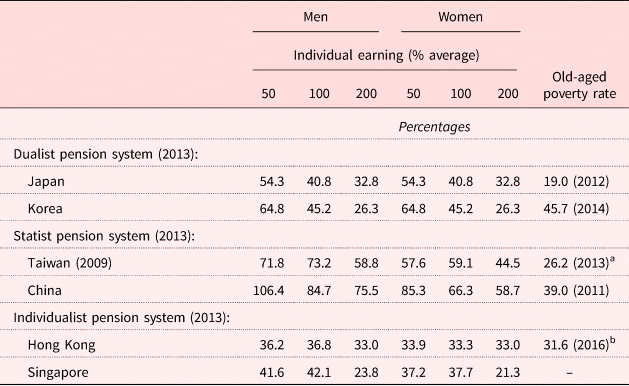

Public Private Pension Mixes In East Asia Institutional Diversity And Policy Implications For Old Age Security Ageing Society Cambridge Core

Private Retirement Scheme Principal Asset Management

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

Beginner S Guide To Private Retirement Schemes Prs In Malaysia

Look Beyond Epf For Retirement The Star

Prs Faq Private Pension Administrator Malaysia Ppa

What S The Difference Of Private Retirement Scheme And Deferred Annuity Plan Kclau Com

A Guide To The Private Retirement Scheme Prs

Prs Provider Public Mutual Berhad Private Pension Administrator Malaysia Ppa

Private Retirement Scheme Principal Asset Management

Ppa S Roles And Responsibilities Private Pension Administrator Malaysia Ppa

How To Choose The Best Private Retirement Scheme Malaysia